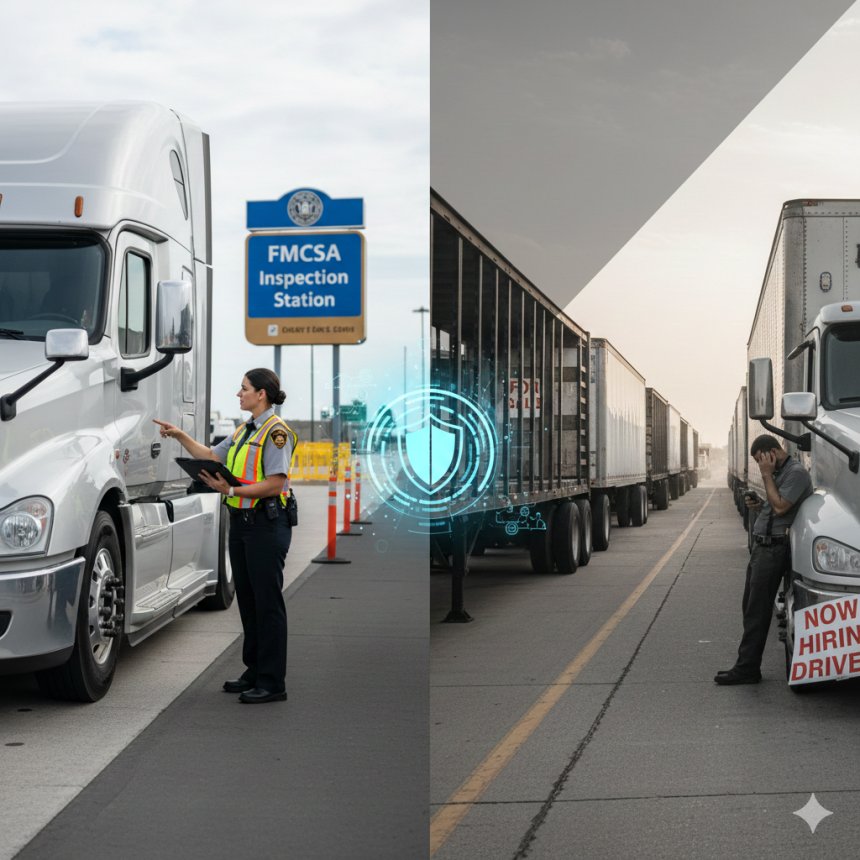

Safety vs. Scarcity: How New FMCSA Enforcement is Reshaping Driver Recruiting

New FMCSA enforcement is shrinking the driver pool. Learn how to navigate the "Safety vs. Scarcity" paradox with FMCSA-certified tools from haulin.ai.

The American trucking industry has long operated in a delicate balance between the desperate need for capacity and the uncompromising demand for road safety. As we move through late 2025, that balance is being disrupted by a wave of aggressive federal oversight.1 The Federal Motor Carrier Safety Administration (FMCSA) has moved from a period of "soft guidance" to high-stakes enforcement, creating a new reality for carriers:

Safety is no longer just a metric; it is the primary gatekeeper of survival. For logistics companies and fleet owners, this shift presents a paradox. While the goal is a safer roadway, the immediate result is a tightening of the driver pool that some analysts are calling the "Great Compliance Squeeze."

The 2025 Enforcement Wave: A Breakdown

In the final months of 2025, the FMCSA, under new leadership directives, has launched several key initiatives that are fundamentally changing how drivers are recruited and retained.

1. The Crackdown on "CDL Mills"

The FMCSA has intensified its oversight of the Training Provider Registry (TPR).3 In a massive sweep this fall, hundreds of training providers were removed for failing to meet Entry-Level Driver Training (ELDT) standards. This "pruning" of the registry means that the days of "weekend CDLs"—where drivers were rushed through substandard programs—are over.

-

The Scarcity Impact: New driver supply is slowing as training programs are forced to lengthen their curricula to meet federal audits.

-

The Safety Benefit: The drivers entering the market are better prepared for the complexities of modern Class 8 equipment.

2. English Language Proficiency (ELP) Assessments

One of the most talked-about shifts in 2025 has been the strict enforcement of 49 CFR 391.11(b)(2).5 Roadside inspectors are now mandated to conduct all initial contacts in English. If a driver cannot sufficiently understand instructions or read highway signs, they are placed Out-of-Service (OOS) immediately.

-

The Scarcity Impact: This has hit cross-border and non-domiciled driver pools particularly hard, with some states seeing significant funding threats from the DOT over non-compliance.

3. Clearinghouse II: The Prohibited Status Downgrade

As of late 2024 and throughout 2025, state licensing agencies are now required to remove commercial driving privileges from any driver with a "prohibited" status in the Drug and Alcohol Clearinghouse.7 This "Clearinghouse II" enforcement has effectively sidelined thousands of drivers who previously occupied a regulatory "gray area."

The Solution: Technology as the Safety Bridge

In this environment, carriers cannot afford to be "reactive." Relying on manual spreadsheets and periodic folder audits is a liability. This is where AI-driven automation and FMCSA-certified partners become essential.

The Role of Haulin.ai

As an FMCSA-certified platform,

Note: Partnering with an FMCSA-certified entity is the most effective way to "audit-proof" your operations before the inspector arrives at your door.

How Enforcement is Changing Recruiting Strategies

Recruiting in 2026 is no longer about finding "anyone with a pulse and a CDL." It is about finding the "Low-Risk Driver."

From "Speed-to-Hire" to "Depth-of-Vetting"

In 2023, the goal was to get a driver behind the wheel in 48 hours. Today, that is a dangerous gamble. New enforcement means that if a carrier hires a driver with a fraudulent CDL or an unresolved Clearinghouse violation, the carrier's Safety Measurement System (SMS) score will skyrocket, leading to higher insurance premiums and lost brokerage contracts.9

The "Flight to Quality"

We are seeing a "flight to quality" where drivers with spotless safety records are commanding record-high pay, while those with even minor violations are finding it harder to secure work. Carriers are increasingly using tools like

Specialized Recruiting: The Case for Precision

When dealing with specialized logistics, such as a

The Economic Reality of Scarcity

The tightening of the driver pool is driving up operational costs in three distinct ways:

| Cost Factor | Description | AI Mitigation Strategy |

| Recruitment Spend | It now costs between $7,000 and $20,000 to hire a qualified driver. | Use AI to target "safety-first" candidates who have higher retention rates. |

| Insurance Premiums | "Nuclear verdicts" and higher SMS scores are driving double-digit premium increases. | Proactive monitoring of driver behavior via FMCSA-certified platforms. |

| Operational Downtime | Drivers placed Out-of-Service at roadside cost thousands in missed delivery windows. | Automate ELP and document checks before the truck leaves the yard. |

Looking Ahead: 2026 and Beyond

The FMCSA’s push for safety is not a temporary trend—it is the new baseline. By October 2025, the agency aims to phase out Motor Carrier (MC) numbers in favor of a single USDOT identifier to reduce fraud and improve data accuracy.10 This will make it easier for regulators to "connect the dots" between unsafe drivers and the carriers who hire them

To survive this era of "Safety vs. Scarcity," trucking companies must transition from being "transportation companies that use computers" to "data-driven organizations that happen to move freight."

Conclusion: Trust, but Automate

The scarcity of drivers is a real and pressing challenge, but sacrificing safety to fill seats is no longer a viable business strategy. The FMCSA has made it clear: they are willing to withhold millions in state funding and shut down thousands of training providers to ensure that only the most qualified drivers are on the road.

By leveraging

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0